Unemployment Letter To Mortgage Company - Can I Collect Unemployment If I M Furloughed From Coronavirus Al Com - A goodwill letter can be an effective way to improve your credit score.

Unemployment Letter To Mortgage Company - Can I Collect Unemployment If I M Furloughed From Coronavirus Al Com - A goodwill letter can be an effective way to improve your credit score.. Hardship letter due to unemployment i am writing to try to {consolidate my loan, avoid foreclosure, restructure a payment plan} for {my mortgage, my personal loan, car loan, etc.}. Having a steady income to repay a loan is a major factor in securing. Mortgage lenders verify employment by contacting employers directly and requesting income information and related documentation. Real letters explaining hardships may 2013 was laid off was laid off, did not have unemployment benefits. Finally found new position, had to relocate for training.

1 contact your lender asking for the loan modification department. Husband's company went out of business, accepted a temporary job which just ended. All they need to do is copy it onto their letterhead, amend the details, print, sign and fax it to your mortgage broker. You may do this online via the mybenefits portal. The letter will allow him to take note of any changes in your income, provide a rental history or any other topic which might need an explanation during the approval process of a mortgage.

A letter of explanation (or loe) is commonly requested by a mortgage lender or underwriter to get specific information from the borrower and complete the loan application process.

Sample letter explaining gap in employment for mortgage loan how detrimental is a gap in employment on a mortgage application. Additions to lender letter on dec. For va and jumbo loans, your lender may require a letter of explanation for gaps in unemployment within the last 2 years. If you have accepted a new job offer, you can use your expected income to meet the requirements. My lender bank of america is not assisting us. Letter of explanations (lox) to mortgage underwriters are often requested letter of explanations should be carefully though out before it is submitted mortgage loan originator will most likely review the letter of explanations prior to submitting it to underwriter who is underwriting mortgage file A letter is only required when said gaps are greater than 30 or 60 days, depending on the type of loan. You may do this online via the mybenefits portal. 1 contact your lender asking for the loan modification department. Mortgage letter of explanation template feb. The letter, dated january 12, 2019, affirmed that the employer was disputing me on the grounds that i was not entitled to the funds. My former employer, xyz enterprises, downsized in june and i. Other names on your credit report your source of income needs explanation (e.g.

You may do this online via the mybenefits portal. If you have accepted a new job offer, you can use your expected income to meet the requirements. When you write a goodwill letter, you are essentially asking a creditor for a break on a reported delinquency. An employment verification letter is often required when a person applies for a loan, attempts to rent property, applies for a new job, or has any other reason to verify their employment history. Additions to lender letter on dec.

My lender bank of america is not assisting us.

You can ask your employer to use this sample letter as a template. Other names on your credit report your source of income needs explanation (e.g. Mortgage lenders might request a letter of explanation for a mortgage loan if they see any red flags or unexplained discrepancies in your credit history or financial documents. Hardship letter due to unemployment i am writing to try to {consolidate my loan, avoid foreclosure, restructure a payment plan} for {my mortgage, my personal loan, car loan, etc.}. Real letters explaining hardships may 2013 was laid off was laid off, did not have unemployment benefits. Thankfully, some companies extended their payment deadlines automatically. Mortgage letter of explanation template feb. Mortgage lenders verify employment by contacting employers directly and requesting income information and related documentation. Letter of explanation is required if borrowers had events below. Download this template as a: Some lenders will need to verify your employment when you apply for a mortgage, line of credit, lease or loan. The letter will allow him to take note of any changes in your income, provide a rental history or any other topic which might need an explanation during the approval process of a mortgage. Finally found new position, had to relocate for training.

It's the job of underwriters to prepare and approve loans for banks. Husband's company went out of business, accepted a temporary job which just ended. Additions to lender letter on dec. Mortgage lenders might request a letter of explanation for a mortgage loan if they see any red flags or unexplained discrepancies in your credit history or financial documents. Others expect to do the same for customers who request it.

Some lenders will need to verify your employment when you apply for a mortgage, line of credit, lease or loan.

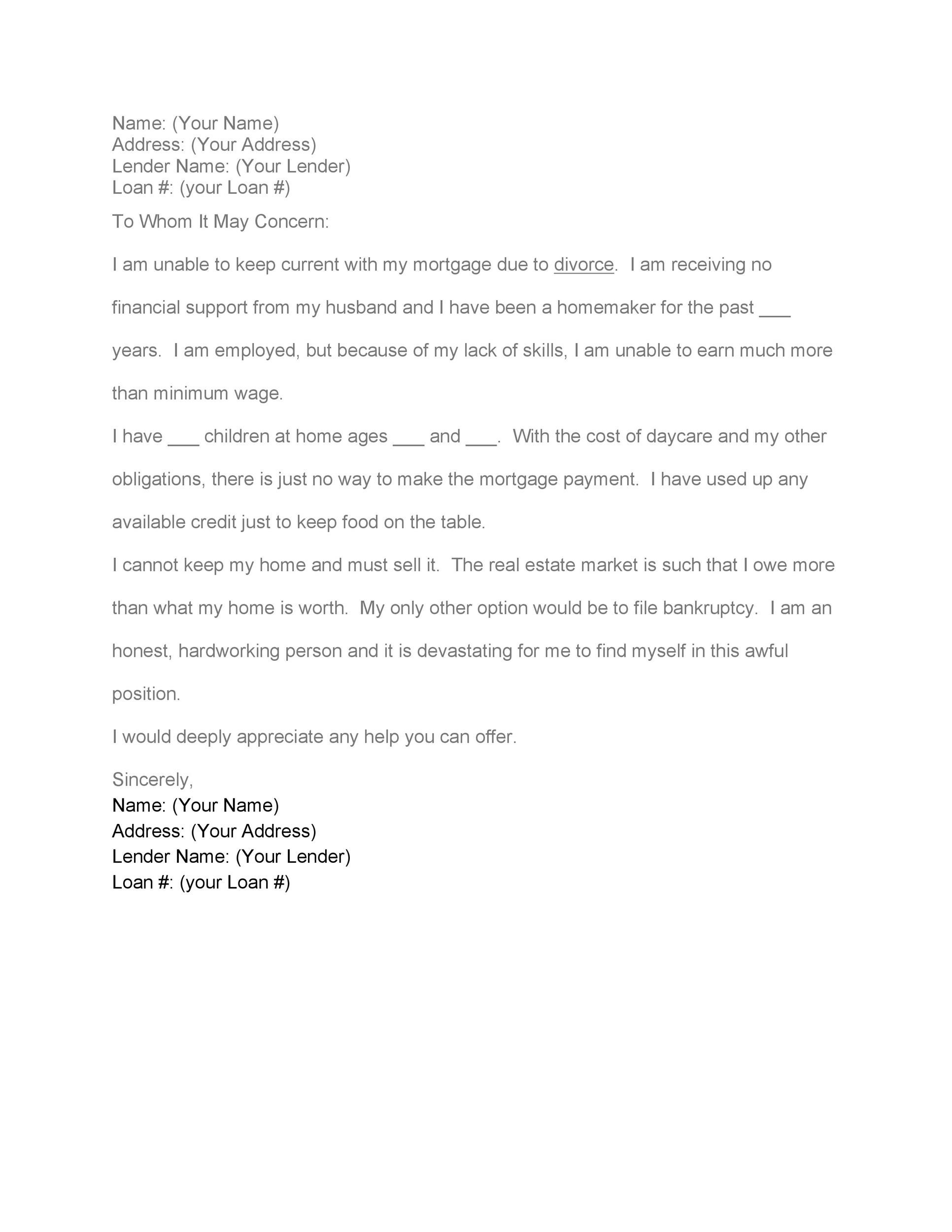

This sample letter provides a modification request based on income loss resulting from unemployment. (text version) company name street address city, st zip code date dear employee name. We also extended suspension of foreclosure activities. Letter of explanations (lox) to mortgage underwriters are often requested letter of explanations should be carefully though out before it is submitted mortgage loan originator will most likely review the letter of explanations prior to submitting it to underwriter who is underwriting mortgage file Mortgage lenders verify employment by contacting employers directly and requesting income information and related documentation. Download this template as a: Jane doe's loan application #123456789 dear sir or madam: Sample letter explaining gap in employment for loan.youll be paying off your mortgage for years and the best terms can save you thousands of dollars over time. Finally found new position, had to relocate for training. Mortgage lenders might request a letter of explanation for a mortgage loan if they see any red flags or unexplained discrepancies in your credit history or financial documents. 1 contact your lender asking for the loan modification department. I fell behind on my payments {or will fall behind} on {date}, due entirely to my protracted spell of unemployment. Mortgage letter of explanation template feb.

Komentar

Posting Komentar